The most typical of these ESG describes the environmental impact, social impact, and corporate governance of a business. Tyler Tysdal Lone Tree. Financial investment specialists utilize ESG scores to assess how particular business are performing along these measurements, and how well those companies align with their own values. It’s not just a matter of excluding the not-so-responsible business, however of engaging them.

Investing for impact is typically explained as investing with a “double bottom line” that is, financial return and a clear, well-articulated set of impact objectives typically, but not constantly, lined up with the United Nation Advancement Program’s 17 sustainable advancement goals. ESG-based investing evaluates companies on a set of criteria specified by the investor, and business design of the company need not explicitly include social impact (Tyler Tysdal).

” It’s not simply a matter of excluding the not-so-responsible business, however of engaging them,” said Ma. “Some customers might still have mining, oil, and gas in their portfolio, for example, but they will be asking those business where they can make improvements.” Climate change is increasingly leading of mind for impact investors, some of whom, like Ma, have an individual interest in climate-conscious investing. Tyler Tysdal Lone Tree.

” I required coal to survive as a child, and every time I return [to China] I see the environmental impacts of burning that coal. I motivate people to think of it,” stated Ma, who categorized resource performance as one of the fastest growing locations of actionable investing. Rao concurred.

From a financier’s perspective, environment modification positions a product danger, which is typically not integrated into the pricing of securities – Tyler T. Tysdal. It affects the business strategy that business have to embrace going forward,” she said. For all their virtue, impact investments are still based on the rules of the marketplace, which postures some distinct difficulties.

” Accomplishing these twin objectives is hard or uncomplicated. It needs additional resources to measure impact and may include higher risk,” said Rao. Attaining these twin goals is not simple or uncomplicated. MIT Sloan financing Assessment can be an obstacle. At minimum, prospective investors wish to examine the ecological, social, and corporate governance of a company with the same rigor that’s used to financial performance however it’s not always a clear-cut examination.

Managing Partner Tivis

As a result, researchers warned, business stock and bond prices are unlikely to properly reflect ESG efficiency, triggering investors to struggle to properly determine out-performers and laggards. Beyond ESG, which mainly concentrates on a business’s functional practices, many financial investment management firms have developed their own frameworks to assess impact. Tyler Tysdal. MIT Investment Conference panelist Quyen Tran, a sustainable financial investment strategist and member of the International Impact group at Wellington Management Co., stated the team tries to find 3 qualities in business it’s considering including to its International Impact portfolio, which is drawn from a universe of approximately 500 openly traded impact business: Materiality (meaning a potential firm’s core services or products rather than its operations should fix a problem that falls under among 3 worldwide impact themes: life essentials; human empowerment; and environment).

Measurability (which provides a method for investors to guarantee the business continues to fulfill or surpass the investors’ impact goals). Then there’s the concern of scalability. Tyler Tivis Tysdal. A startup that offers finding out innovation to underserved high schoolers in Africa may be delivering direct impact, but does it have the possible to grow, Rao asks both in the sense of widening and deepening its impact, but likewise its ability to provide returns.

” There’s a tradeoff here – Tyler Tysdal. With the Unilevers of the world, the impact may be diffuse, however the scale is huge. It’s not an either-or decision.” Finally, there’s the concern of investment horizon. Impact projects by their nature tend to need long development cycles to come to fruition. Investors may have much shorter time horizons and lower threat tolerance.

” Impact tasks include upfront costs with the advantages frequently accumulating over the long term. Investors require to be client.” Ma, who as soon as authored a report entitled “Risks and Opportunities from the Altering Environment: Playbook for the Truly Long Term Investor,” thinks that longest view is in harmony with Cambridge Associates’ fiduciary responsibility to its clients (Tyler Tysdal).

” Our clients are stewards of capital that they wish to preserve for years, for a couple of a century. We would not be doing our jobs if we weren’t recognizing threats and opportunities with those timeframes in mind.”.

Our region’s dedication to community is on full display in the pages of this issue, with companies taking on a large range of obstacles and causes. Some concentrate on environment change through green items or their own sustainability efforts. Others empower the labor force of the future through task advancement and social entrepreneurship.

Tysdal Grant Carter

While the strategies of each business or company might vary, their desire to produce positive modification ties them together. Each has their own factors for their neighborhood engagement and derives their own utility from their initiatives. The most effective and sustainable are those that specify their desired outcome early and use it as an assisting force.

In other words, impact investing is investing in business, funds and jobs to create both a measurable social benefit and a monetary return. It’s a recognized however progressing phenomenon driven by the recognition that individuals can affect a business’s business citizenship. Like neighborhood impact, while the techniques may be different, each financier shares a desire to produce favorable modification.

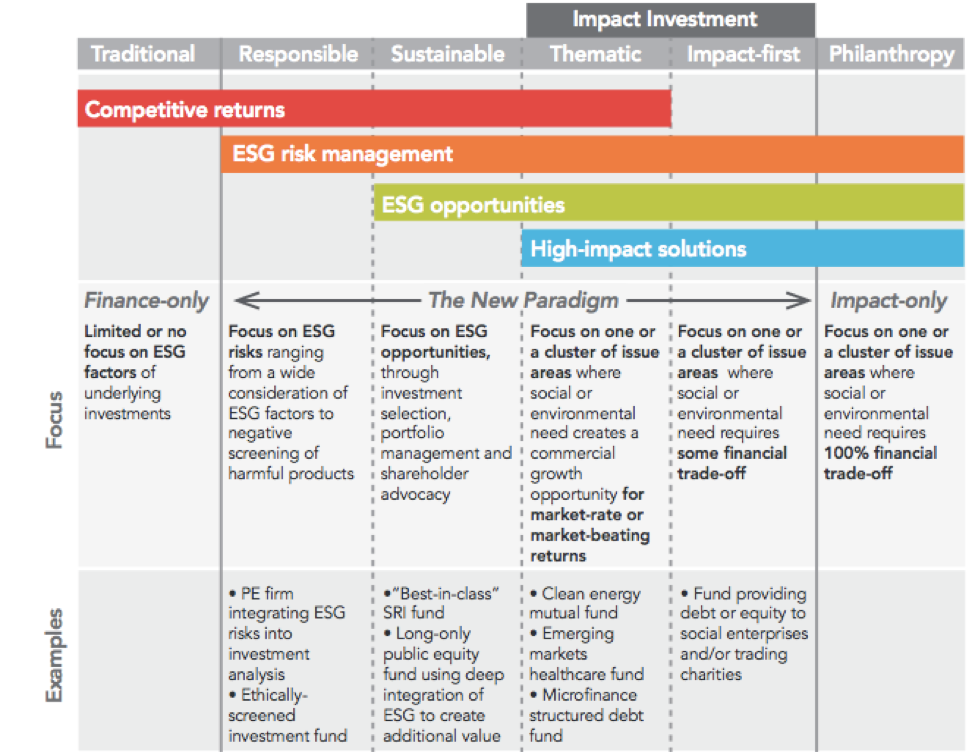

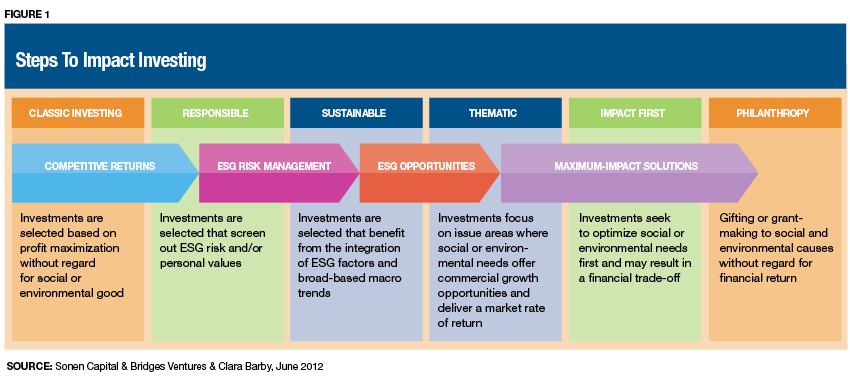

Nevertheless, any financier is ultimately limited by the valuable investment choices. We think about impact investing as a spectrum. At one end, the focus is on filtering out companies whose values are not aligned with an investor’s, like those included with tobacco and firearms, while assigning capital to business that fulfill particular environmental, social and governance (ESG) metrics.

Traditional measures of financial investment success focus on return and threat. Determining the success of an impact financial investment involves more than simply monetary return. In client conversations, I typically refer to this as the energy of return, or the private worths in financial gain combined with the social worth of their financial investments.

For example, performance metrics of sustainable power financial investments may highlight the power created from renewable resources and the “impact stats,” such as the displacement of greenhouse gases by not producing power from fossil fuels – Tyler Tysdal Lone Tree. In another case, people might purchase affordable-housing projects that aren’t developed to deliver market-rate returns and require a longer-term dedication.

The energy in this case consists of developing something tangible to address a social problem in the community. Utility likewise helps set metrics to determine efficiency in private financial investments. Tyler Tivis Tysdal. Does that private renewable-energy task provide utility based on just how much carbon it offsets or how numerous tasks it develops? What’s the step of success for budget-friendly housing? Is it the variety of living-wage units offered, the number of families can be housed, how it’s supporting a particular part of the population or something else? Energy is important to impact investing because it specifies success.